• Expertise and Support from the EU: As a full-service EU based Vat services firm rather than a software as a service vendor, we provide a fully integrated service for EU VAT registration and filings.

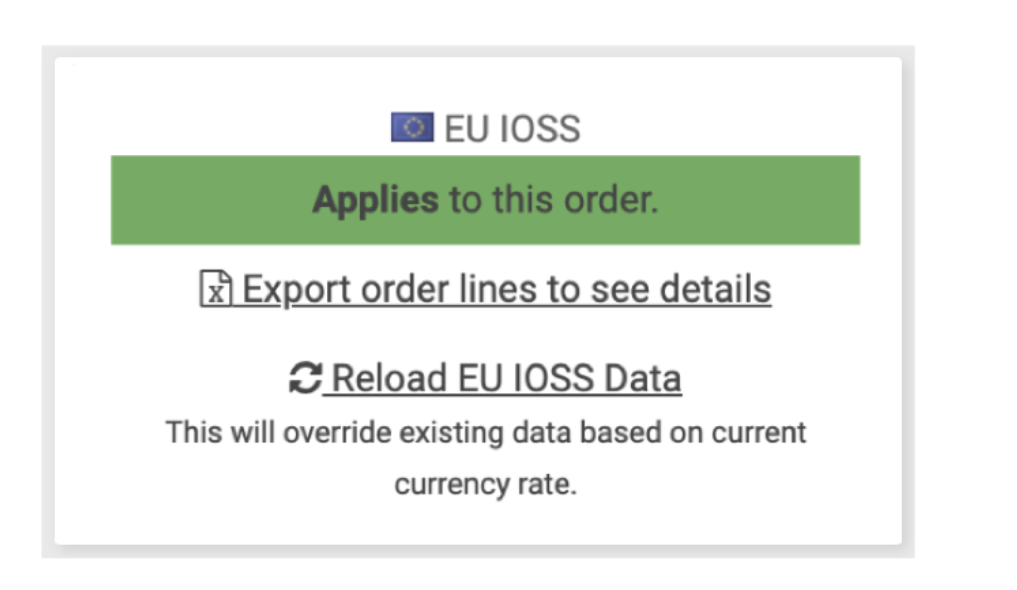

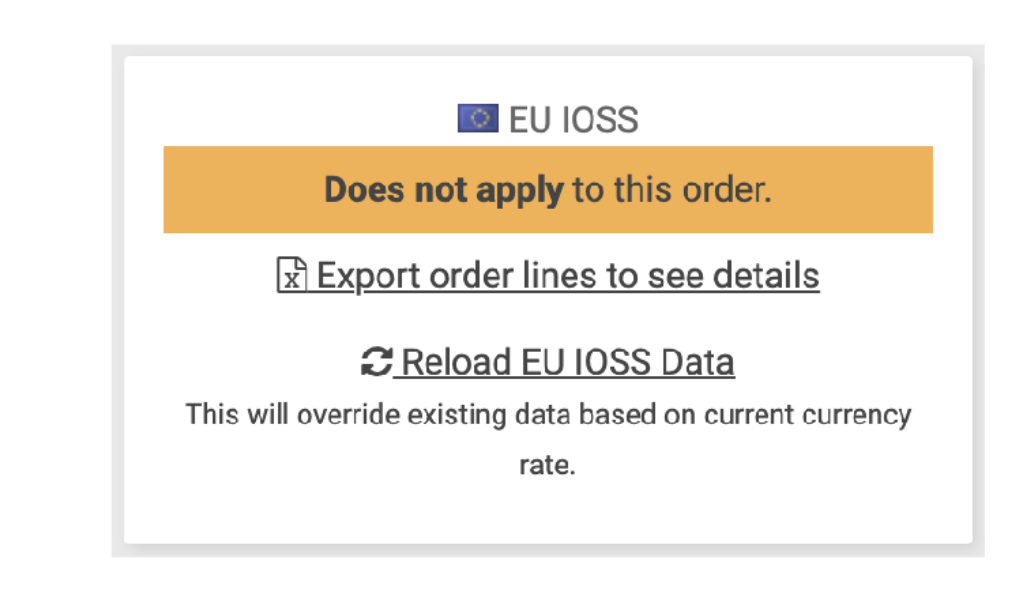

• VAT Compliance: The EU’s rules regarding VAT for digital services are complex. We provide tools and services that ensure North America businesses comply with these regulations, ensuring they charge the correct VAT rates for each EU member state.

• Streamlined payment solutions: North American businesses can avoid expensive quarterly international bank wire costs and foreign exchange transactions fees by using our Vat payment system. This allows North American businesses pay their quarterly Vat payments in USD to a domestic US account.

• Simplified EU VAT Registration: Our expertise in EU Vat means that we are able to provide a more streamlined registration process, making it easier for North American businesses to get registered for EU VAT OSS or IOSS.

• Reporting & Filing: Keeping track of sales, VAT collected, and ensuring timely and accurate filings can be daunting. We provide consolidated reports, making the filing process more straightforward and ensuring businesses meet all deadlines.

• Service not software: We are not a software as service vendor, our Vat teams work with the most popular e-commerce platforms, making it easier for businesses to work with us.